The recent volatilities in the market and especially in the price of the Dollar Index (USDX) have raised many questions regarding the nature of this index and what affects it. in this short article, I will draw on established articles and widely accepted definitions to explain, in an easy language, what is the dollar index made up of.

- Table of contents:

- An overall review of the Dollar index and what it is made up of

- What is the dollar index made up of

- Technical aspects of U.S. dollar index

- Analayzing and trading the U.S. Dollar index

- Final tips: what is the dollar index made up of and how is it calculated?

An overall review of the Dollar index and what it is made up of

In the first section of this post, I will describe in very simple language what the USDX is and what the dollar index is made up of. In this section, I will not get into details and will use simple language to share the idea behind this index.

if you want more information regarding the dollar index and the details about what it is made up of, read the next section.

So… what is the dollar index made up of?

Simply put, the Dollar Index or the USDX, is made of 6 different currencies. You can see the list of the currencies below:

- Euro (EUR)

- Japanese Yen (JPY)

- British Pound (GBP)

- The Canadian dollar (CAD)

- Swedish Krona (SEK)

- Swiss Franc (CHF)

But this is a tricky subject! why? because at the first glance, you might think that only 6 counties affect the price of the USDX. If you think so, I have to say that YOU ARE WRONG!

The reason is a simple one: the euro is the official currency of nineteen of the twenty-seven member states of the European Union. If you add the other 5 countries (that is, Japan, Great Britain, Canada, Sweden, and Switzerland) and their accompanying currencies it will sum up to 24 countries. obviously, only 24 countries make up a small portion of the globe, however, many other currencies follow the U.S. Dollar index very closely.

This fact makes the USDX a pretty good tool for measuring the U.S. dollar’s global strength. So that’s it! if you wanted to know what is the dollar index made up of in a simple language and without going into further detail, I hope you got the answer you were looking for.

HOWEVER, if you want more details, read the sections below where I have delved into the topic in depth.

Technical aspects of the U.S. Dollar Index (USDX)

The U.S. dollar index (USDX) is a measure of the value of the U.S. dollar relative to a basket of foreign currencies. The USDX was coined by the U.S. Federal Reserve in the year 1973 after the dissolution of the Bretton Woods Agreement. The Index is now maintained by ICE Data Indices, a subsidiary of the ICE (intercontinental exchange).

The dollar index is made up of six currencies and is often referred to as America’s most significant trading partner.

Nonetheless, the index has been updated only once; in 1999 when the euro replaced the German mark, French franc, Italian lira, Dutch guilder, and Belgian franc. Therefore, you might think that the index does not accurately reflect present-day U.S. trade. If so, you would be correct.

The currencies affecting the U.S. Dollar Index

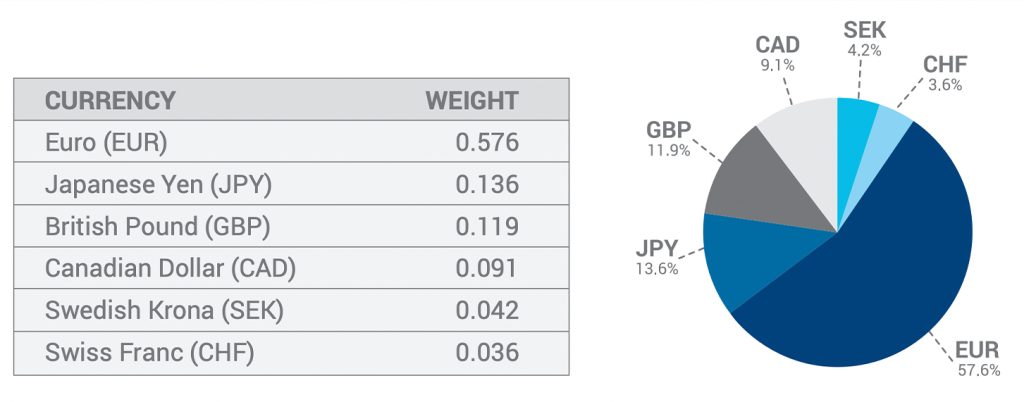

To better answer the question: “what is the dollar index made up of?” we should also point out how the 6 currencies are weighted. The USDX is calculated by factoring in the exchange rates of the 6 foreign currencies mentioned above. you can also take a look at the graph below to see how the weighing is done.

We can clearly see that the Euro is, by far, the largest component of the USDX (making up nearly 58% of the basket). The weights of the remaining currencies in the index are as follows: JPY 13.6%, GBP 11.9%, CAD 9.1%, SEK 4.2%, and CHF 3.6%.

According to Investopedia: “The index started in 1973 with a base of 100, and values since then are relative to this base. It was established shortly after the Bretton Woods Agreement was dissolved. As part of the agreement, participating countries settled their balances in U.S. dollars (which was used as the reserve currency), while the USD was fully convertible to gold at a rate of $35/ounce. “

Analyzing and Trading the U.S. Dollar Index

An index value of 120 suggests that the U.S. dollar has appreciated 20% versus the basket of currencies over the time period in question. Simply put, if the USDX goes up, that means the U.S. dollar is gaining strength or value when compared to the other currencies.

Similarly, if the index is currently 80, falling 20 from its initial value, that implies that it has depreciated 20%. The appreciation and depreciation results are a factor of the time period in question.

The U.S. dollar index allows traders to monitor the value of the USD compared to a basket of select currencies in a single transaction. It also allows them to hedge their bets against any risks with respect to the dollar. It is possible to incorporate futures or options strategies on the USDX.

Can I trade ICE U.S. Dollar Index contracts at any time?

According to the official document by ICE, “U.S. Dollar Index contracts trade electronically on the ICE electronic trading platform from 8:00 pm through 5:00 pm. ET the next day Monday through Thursday. “

Trading ends at 5:00 p.m. ET on Friday afternoon. On Sunday evening, trading in the contracts begins at 6:00 p.m. ET; the trading session that begins on Sunday evening ends at 5:00 p.m. ET on the following Monday evening. The ICE trading platform is available for order entry thirty minutes before the opening of trading.

Final tips: what is the dollar index made up of and how is it calculated?

After reading the post and getting familiar with what is the dollar index made up of, you might ask why such an information is necessary for traders. Below, I have mentioned some of the reasons why understanding USDX is an important subject for people interested in trade.

- First, the US Dollar Index is important for traders both as a market in its own right and as it is an indicator of the relative strength of the US Dollar around the world. It can be used in technical analysis to confirm trends related to most markets.

- Second, commodity prices tend to fall as the Dollar increases in value – and vice versa. Currency pairs, on the other hand, generally move in the same direction as the Dollar Index if USD is the base currency, and opposite direction if it is the quote currency – though these ‘rules’ do not always hold true.

- Third, many traders also use the index to hedge risk – for example, offsetting some of the risk associated with a long USD/JPY trade by going short on the Dollar Index.

If you like this post, do not forget to follow us on our social media. You can find us on Instagram and if you’re looking for more information regarding the market and trading signals, check out our Telegram channel!